Dispensaries Misleading Consumers, Selling THCA Flower?

State-Licensed Cannabis Dispensaries Misleading Consumers with Cannabis Taxes on Federally Compliant THCA Flower

The cannabis industry has seen significant changes over the last decade, from shifting legal landscapes to the proliferation of new products aimed at both medical and recreational users. However, not all developments in the cannabis market have been entirely consumer-friendly. One particularly concerning issue is the growing trend of state-licensed dispensaries misleading consumers by charging cannabis taxes on federally compliant THCA flower.

While THCA flower is federally legal—due to its non-psychoactive nature and lack of detectable THC—dispensaries in some states have begun charging cannabis taxes as if it were a traditional cannabis product containing active THC. This not only confuses consumers but raises serious questions about whether dispensaries are adhering to both federal and state regulations in a transparent and ethical manner.

Let’s break down the situation, explore how this misleading practice is affecting consumers, and look at the broader implications for the cannabis market.

What is THCA Flower, and Why is It Federally Compliant?

To understand the issue, it’s important to first clarify what THCA flower is and why it’s different from the typical cannabis flower.

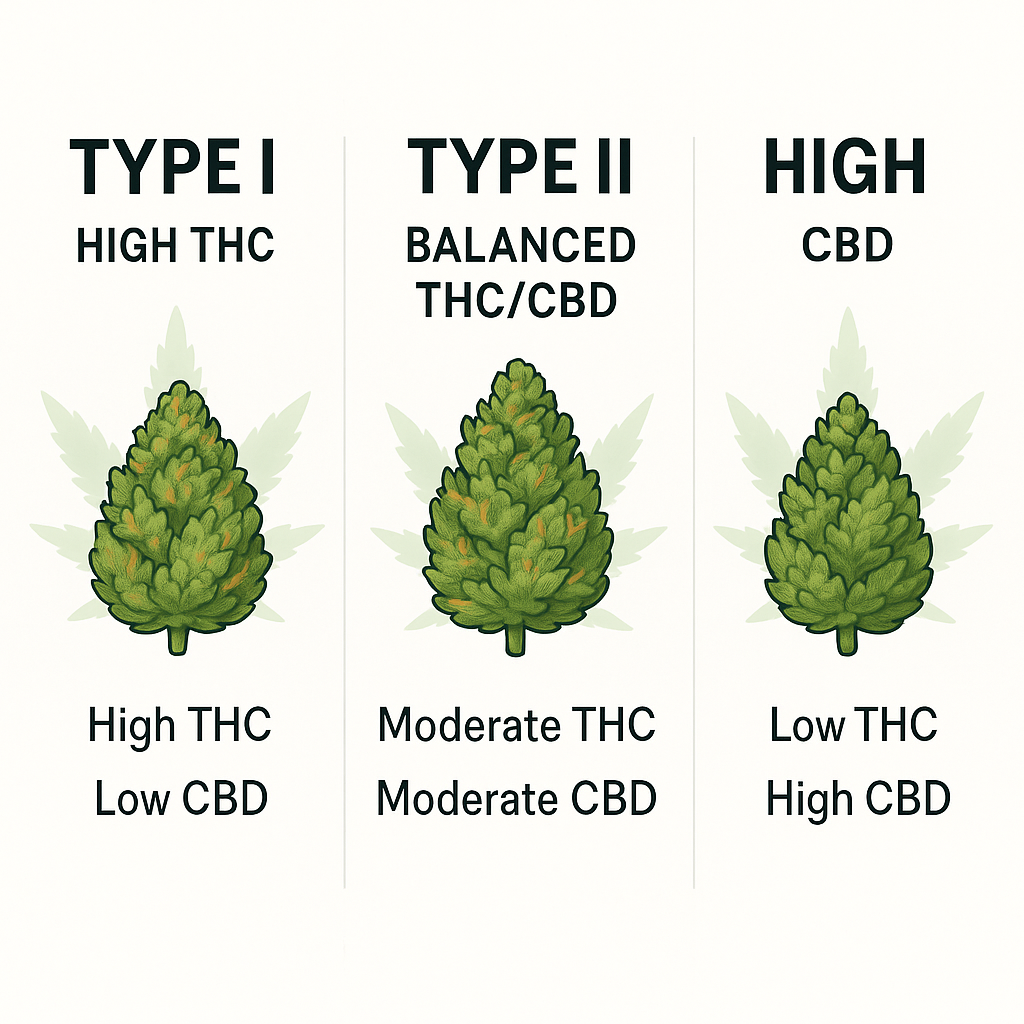

THCA (tetrahydrocannabinolic acid) is the precursor to THC (tetrahydrocannabinol), the psychoactive compound most commonly associated with cannabis. In its natural, raw form, THCA does not produce the intoxicating effects that THC does, making THCA flower non-psychoactive. It’s only when THCA is heated—through smoking, vaping, or baking—that it converts into THC, which is when users experience the typical "high."

Because THCA flower doesn’t contain active THC in its raw form, it technically does not fall under the federal Controlled Substances Act's definition of illegal cannabis. This distinction became clear when the 2018 Farm Bill legalized hemp derivatives, which includes THCA flower, as long as it contains less than 0.3% THC by weight.

This federal legality has led many cannabis consumers to assume that THCA flower should not be subject to the same regulations and taxes as traditional cannabis products containing THC. However, some state-licensed dispensaries have been charging cannabis taxes on THCA flower, which raises important questions about the fairness and legality of such practices.

How Are Dispensaries Misleading Consumers?

- Charging Cannabis Taxes on THCA Flower: In many states, cannabis taxes are structured with the idea that products containing THC are subject to higher rates due to their psychoactive effects. However, dispensaries have been charging consumers the same cannabis taxes for THCA flower that they would pay for products containing active THC. This is misleading because, by federal law, THCA is not considered cannabis in the same way as products with higher THC content.

- Lack of Transparency: Many dispensaries are not clearly explaining the distinction between THCA flower and THC flower to consumers. Instead, they simply market THCA flower as a cannabis product, with no emphasis on the fact that it is federally compliant and technically does not meet the legal definition of a controlled substance. This lack of transparency can lead to confusion, especially among consumers who believe they are paying taxes on a legal, non-intoxicating product when, in reality, they’re being taxed as if it were THC-heavy cannabis.

- Potential Overcharging: By charging cannabis taxes on THCA flower, dispensaries are essentially overcharging consumers. Since THCA flower is federally compliant and non-psychoactive, it could be argued that it should not fall under the same taxation rules as typical THC products. As a result, some consumers may be unknowingly paying more for a product that is technically outside the scope of state cannabis tax regulations.

Why Are Dispensaries Doing This?

It’s crucial to understand why some dispensaries may be engaging in this practice. While some may argue that they are simply following local regulations and interpreting cannabis tax laws conservatively, others may be motivated by financial incentives. Here are a few possible reasons:

- Lack of Clarity in Tax Regulations: Cannabis tax laws are still evolving, and there’s often a lack of clarity surrounding new products like THCA flower. States have not fully updated their tax codes to account for the unique nature of THCA flower, leading to confusion among dispensary owners about how to classify and tax it.

- Profit Maximization: Some dispensaries may view THCA flower as a revenue-generating opportunity, charging consumers a premium and applying cannabis taxes without fully considering its federal compliance status. With growing demand for alternative cannabis products, including THCA, dispensaries may be capitalizing on this niche market by applying taxes more aggressively.

- Gray Area in Legal Interpretation: The legal status of THCA is somewhat ambiguous in certain states, leading some dispensaries to play it safe and apply cannabis taxes across the board to all cannabis-related products. As laws continue to evolve, dispensaries may not yet have clear guidelines on how to handle the taxation of THCA flower, prompting them to charge consumers the same way they would for THC flower.

Implications for Consumers and the Cannabis Market

- Overpaying for Products: Consumers may unknowingly be paying more than they should for THCA flower. As taxes on cannabis can significantly increase the cost of a product, this overcharging could be a barrier for some individuals who are looking for affordable, non-psychoactive alternatives to THC-based products.

- Erosion of Consumer Trust: If consumers continue to feel misled or overcharged by dispensaries, it could damage the trust between the cannabis industry and its customers. Transparency and fair pricing are key to building a loyal customer base, and misleading practices could drive consumers away, especially in a market where choices are abundant.

- Legal and Regulatory Issues: The application of cannabis taxes to THCA flower may not only be misleading but could be illegally inflating prices, which might eventually lead to regulatory scrutiny. As states refine their cannabis tax laws, dispensaries may face penalties or fines for improperly classifying and taxing products that are federally compliant.

- Market Fragmentation: Dispensaries charging varying tax rates for THCA flower could result in a fragmented market where some businesses are overcharging, while others may be more transparent or follow alternative tax guidelines. This could create confusion for consumers and could drive them toward black market sales, where taxes are nonexistent, and prices are lower.

Moving Forward: What Can Be Done?

- Clearer Regulations: States need to clarify how THCA flower should be treated under cannabis tax laws. As the legal landscape continues to shift, lawmakers should create explicit rules for new cannabis products, ensuring that federally compliant products like THCA are not unfairly taxed at the same rates as traditional THC-heavy cannabis products.

- Transparency in Labeling: Dispensaries should be more transparent in their labeling and marketing practices. Educating consumers about the differences between THCA flower and THC flower can help consumers make more informed purchasing decisions and avoid unnecessary overcharges.

- Advocacy for Fair Taxation: Consumer advocacy groups and industry leaders should work together to lobby for fair and reasonable tax policies on emerging cannabis products. Ensuring that THCA flower remains affordable for those seeking non-psychoactive relief is critical for creating a balanced, equitable market.

Conclusion

The growing trend of state-licensed dispensaries misleading consumers and charging cannabis taxes on federally compliant THCA flower is a problem that must be addressed. While some dispensaries may be acting in good faith, many are taking advantage of the ambiguity in cannabis tax regulations to increase their revenue, ultimately burdening consumers with higher prices. Clearer regulations, transparency in marketing, and fair taxation are essential to ensure that the cannabis industry remains ethical, transparent, and consumer-friendly as it continues to evolve.

To Shop our THCA and Delta-9 THC products taxed at the appropriate rate: CLICK HERE